Safaricom introduced new M-Pesa charges. These new rates came as a result of a 2% increment (from 10% to 12%) in mobile money transaction costs as announced by the Treasury cabinet Secretary, Henry Rotich. With the new M-Pesa sending and withdrawal charges, registered Safaricom users will pay KSh15 for sending KSh1000 and KSh28 to withdraw the same amount from an M-Pesa agent.

According to Safaricom, sending less than 100bob is still free, however, you will be charged KSh10 to withdraw the same amount. However, some users have complained on social media that they are being charged 1 bob for sending KSh50 and below and 2bob for sending Ksh100. The rate increment doesn’t apply to other services such as buying airtime, balance inquiry, registration, and changing your M-Pesa pin.

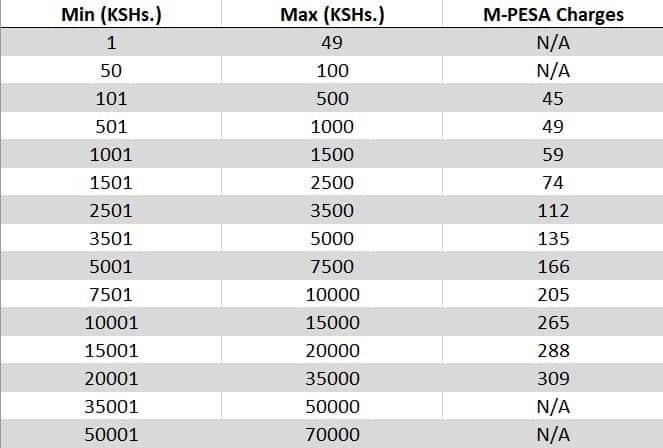

Safaricom M-Pesa sending charges

Sending charges depend on a variety of factors including whether the recipient is registered or not and whether they are using a different phone carrier.

Sending charges to unregistered customers

You will be as little as 0 and a maximum of KSh309 for sending money to unregistered users.

M-Pesa transfer fees to other M-Pesa users

To send money to registered M-Pesa users, you wont pay anything for any amount below one hundred shillings. However, you will part with KSh105 in transaction charges to send Ksh50,000 and above.

M-Pesa transfer to other mobile money users

If you wish to send money to Airtel or Telkom users, you will pay practically the same rate as M-Pesa to M-Pesa transactions. This table shows the charges you will incur.

The maximum cash you are allowed to send via M-Pesa is KSh70,000 for each transaction. Moreover, the maximum M-Pesa (daily) transaction limit lies at KSh140,000. Note that according to M-Pesa rates latest changes, you will pay an additional fee to send cash to non-registered M-Pesa subscribers.

M-pesa withdrawal charges

Just the way the M-Pesa tariffs for sending money differ depending on the amount of money you are sending, the same case applies to M-Pesa withdrawal charges. The more you want to withdraw the more the transaction cost is.

M-Pesa withdrawal charges differs depending on the mode of withdrawal. Withdrawing from an agent is cheaper than withdrawing from an ATM. The maximum you can withdraw is 20,000 and the minimum is 200 when using an ATM.

M-Pesa withdrawal from an agent

To withdraw money from an M-Pesa agent you are required to produce your National ID, Passport, Military ID or Alien ID/Foreigner Certificate. This is the most popular withdrawal option. It is free to send anything below KSh50. It will cost you KSh10 to withdraw KSh50-100 while you will be required to pay KSh 300 to withdraw KSh70,000.

M-Pesa withdrawal tariffs from an ATM

As mentioned earlier it is possible to withdraw money from an ATM. This is usually highly beneficial in areas that have no M-Pesa agents but have ATM's. Here are the rates for withdrawing cash from an ATM.

Note

Maximum Account Balance is KSHs.100,000

Maximum Daily Transaction Value is KSHs.140,000.Maximum per transaction is KSHs.70,000

You cannot withdraw less than KSHs.50 at an M-PESA agent outlet

To transact, your Safaricom line and M-PESA account must be active

At an agent outlet, you cannot deposit money directly into another M-PESA customer's account

You earn Bonga points when you transact on M-PESA.

To register or transact at any M-PESA Agent outlet, you will be required to produce your original identification document, i.e., National ID, Passport, Military ID or Alien ID/Foreigner Certificate

The new M-Pesa charges for withdrawing as well as sending money have been highlighted above. I hope this article will help make all your M-Pesa transactions easier. Share with us your views on the new M-Pesa tariffs.